Be a Savvy Swiper: When to Use Debit and Credit

Both debit cards and credit cards come with safeguards to prevent fraud. When you use a debit card at a grocery store or gas station, for example, you are often required to provide a unique PIN. When you shop with credit online, you’re often required to enter your credit card’s three-digit security code.

With a credit card, you are essentially borrowing money from your line of credit, whereas the debit card immediately takes the money from your connected bank account to pay for purchase. For example, if you have $550 in your checking account, and pay for $100 worth of groceries with a debit card, your balance will be $450. The withdrawal is immediately reflected in your current balance. From the bank’s point of view, when a debit card is used to pay a merchant, the payment causes a decrease in the amount of money the bank owes to the cardholder. From the bank’s point of view, your debit card account is the bank’s liability. From the bank’s point of view, when a credit card is used to pay a merchant, the payment causes an increase in the amount of money the bank is owed by the cardholder.

Pros of debit cards

And if you carry a balance (no matter how small), you’ll end up paying more than if you’d paid with cash. Credit card companies have spent a ton of time and money trying to convince you that credit cards are the only way to go. In fact, 8 in 10 adults in America (84%) have at least one credit card.4 The credit card companies in their shiny towers are counting on your participation to make them a profit.

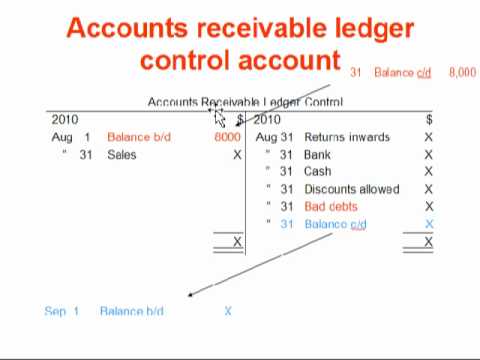

Let’s say your company sells $10,000 worth of monitor stands, and you’re based in Arizona, where the state sales tax is 5.6%. The total charge to the customer is $10,560, which will be the exact amount you will debit (increase) your accounts receivable. You will also debit (increase) your COGS accounts, which we’ll earmark as $5,000.

Her work has appeared in Business Insider, Forbes, and The New York Times, and on LendingTree, Credit Karma, and Discover, among others. Choosing credit could still benefit you for other reasons, but if you use a small regional bank or credit union, you might be able to save the merchant some money by entering your PIN. Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can. Compensation may factor into how and where products appear on our platform (and in what order). But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you.

Debits and credits definition

Debit cards, like credit cards, come with a unique number that allows you to make purchases in person or online, quickly. The big difference between debit and credit is that debit cards withdraw money from a linked checking account. Instead of making a purchase now and paying it off later, a debit card immediately draws from your account to pay for the entire amount. As long as there’s enough money in your checking account, your debit card purchase should be approved.

- Since a debit card is linked directly to a bank account, fraudulent purchases can quickly drain an account dry or lead to an overdraft.

- Debits and credits are the true backbone of accounting, as any transaction recorded in a ledger, whether it’s hand-written or in your accounting software, needs to have a debit entry and a credit entry.

- “In fact, most debit cards don’t offer rewards at all,” he says.

Debits and credits are used in a company’s bookkeeping in order for its books to balance. Debits increase asset or expense accounts and decrease liability, revenue or equity accounts. When recording a transaction, every debit entry must have a corresponding credit entry for the same dollar amount, or vice-versa. Since these purchases withdraw funds from your account immediately, debit cards may be a good way to ensure you don’t spend more than you have. However, debit card transactions may cause overdraft fees and have limited fraud protection. The concepts of debits and credits may be clear to accountants and bookkeepers, but they take some getting used to when you’re a business owner who thinks in the everyday terms of credit and debit cards.

Credit Cards vs. Debit Cards: An Overview

Or you may have purchase and price protection built-in to help you either replace items that are stolen or lost, or refund price differences when the item that you purchased is sold elsewhere for less. That includes positive history, such as on-time payments and low credit utilization ratios, as well as negative items, such as late payments or delinquencies. Your credit report information is then used to calculate your credit scores. Responsible spenders can raise their scores with a history of expenditures and timely payments, and by keeping their card balances low relative to their card limits. Credit card users can reap cash, discounts, travel points, and many other perks unavailable to debit cardholders by using rewards cards. You could then use miles earned to book future travel arrangements.

For example, if you return an item to a merchant and you’re not able to get a refund, you instead may qualify for store credit or a gift card. Sal records a credit entry to his Loans Payable account (a liability) for $3,000 and debits his Cash account Using Debit and Credit for the same amount. To understand how debits and credits work, you first need to understand accounts. In this guide, we’ll provide an in-depth explanation of debits and credits and teach you how to use both to keep your books balanced.

This is why you might notice a sign at some stores saying you have to spend a certain amount in order to pay using a credit card. As such, most credit unions and banks charge lower fees for accepting this type of payment method. In many cases, the transaction is processed directly with the issuing credit union or bank, and the funds are immediately deducted from your available balance.

They Prevent Debt, but Funds Run Out

Some credit cards even offer extended warranties on items you purchase as well as limited travel insurance. In contrast, you have to apply for a credit card separately, and some cards are limited to people with high credit scores. If you get a card from a bank other than where you do your banking, it also won’t be linked to a bank account, which introduces more complexity to your finances. You’ll often have one more username and password, another card number that can get stolen, and an extra payment you need to stay on top of each month. If you’re looking to limit your spending, a debit card can help you spend only what you already have. And while you should definitely stay on top of your account activity, debit cards don’t require you to pay a bill every month.

- If you have not properly budgeted for that expense, it may be a burden on the available

balance in your checking or spending account. - When you swipe a credit card, it feels like you’re playing around with imaginary money, so it’s easier to spend more of it.

- If you want extra cardholder protections, choosing credit would probably be better.

Assets are items that provide future economic benefits to a company, such as cash, accounts receivable, inventory, and equipment. Learn more about how credit cards work and how credit card interest works. At Bankrate we strive to help you make smarter financial decisions. While we adhere to strict

editorial integrity,

this post may contain references to products from our partners. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired.

Part of your role as a business is recording transactions in your small business accounting books. And when you record said transactions, credits and debits come into play. So, what is the difference between debit and credit in accounting?

Consumers Energy to add $2.99 to bills when paid using debit … – FOX 17 West Michigan News

Consumers Energy to add $2.99 to bills when paid using debit ….

Posted: Wed, 16 Aug 2023 21:24:38 GMT [source]

Start by reading the disclosures that explain the account terms and fees to understand the potential benefits as well as the costs. All changes to the business’s assets, liabilities, equity, revenues, and expenses are recorded in the general ledger as journal entries. One advantage of choosing credit and signing when making debit card purchases is that the card networks may offer you protections, such as zero liability for fraudulent purchases. Although it’s not common, some banks and credit unions may charge you a fee if you make a purchase using your debit card.

Personal Banking Overview

Otherwise, an accounting transaction is said to be unbalanced, and will not be accepted by the accounting software. Business transactions are events that have a monetary impact on the financial statements of an organization. When accounting for these transactions, we record numbers in two accounts, where the debit column is on the left and the credit column is on the right. By following these debit and credit rules, you will be assured of making entries in the general ledger that are technically correct, which eliminates the risk of having an unbalanced trial balance. You would debit (reduce) accounts payable, since you’re paying the bill.

In contrast, you can only spend money you have with a debit card, so it can curb the impulse to spend. If you’re not able to pay your balance in full, check how much the minimum payment is. It’s the smallest amount you can pay each billing cycle to keep your account current. Paying your minimum payment on time can help you avoid some potential consequences like late fees and penalties.

Many credit card companies offer free credit score monitoring and tracking as a card perk, so you can keep an eye on your progress when building credit. Debits and credits are equal but opposite entries in your books. If a debit increases an account, you must decrease the opposite account with a credit. Because funds are deducted from your account very quickly, don’t expect to have the option to stop payment or obtain a refund. If the transaction cannot be cancelled, you may be able to work out other arrangements with the store.

On the bank’s balance sheet, your business checking account isn’t an asset; it’s a liability because it’s money the bank is holding that belongs to someone else. So when the bank debits your account, they’re decreasing their liability. When they credit your account, they’re increasing their liability. The next month, Sal makes a payment of $100 toward the loan, $80 of which goes toward the loan principal and $20 toward interest. To record the payment, Sal makes a debit entry to the Loans Payable account (to decrease the liability), a debit entry to Interest Expense (an expense account), and a credit entry to his cash account.

A big difference between debit and credit cards is that debit cards don’t affect your credit score. When used properly, credit cards can be a helpful way to build credit. If you trust yourself to spend wisely and consistently make on-time payments, they’re a great option. They also offer strong fraud protection, which is especially useful when making online purchases.

If you are really confused by these issues, then just remember that debits always go in the left column, and credits always go in the right column. Kashoo is an online accounting software application ideally suited for start-ups, freelancers, and small businesses. The inventory account, which is an asset account, is reduced (credited) by $55, since five journals were sold.