Working Capital Formula & Ratio: How to Calculate Working Capital

By only looking at immediate debts and offsetting them with the most liquid of assets, a company can better understand what sort of liquidity it has in the near future. The working capital ratio shows the ratio of assets to liabilities, i.e. how many times a company can pay off its current liabilities with its current assets. Knowing the difference between working capital and non-cash working capital is key to understanding the health of your cash flow and the liquidity of your current assets and obligations. Therefore, working capital ratio is a measure of whether a business is operating with a net positive or negative working capital position. Represented as a ratio, if the figure is 1 or above, the business has net positive working capital. Accounts receivable days, inventory days, and accounts payable days all rely on sales or cost of goods sold to calculate.

Tracking it is key, since you need to know that you have enough cash at your fingertips to cover your costs and drive your business forward. If future periods for the current accounts are not available, create a section to outline the drivers and assumptions for the main assets. Use the historical data to calculate drivers and assumptions for future periods. See the information below for common drivers used in calculating specific line items. Finally, use the prepared drivers and assumptions to calculate future values for the line items.

The net effect is that more customers have paid using credit as the form of payment, rather than cash, which reduces the liquidity (i.e. cash on hand) of the company. Measuring working capital over a prolonged period can offer better financial insight than a single data point. To calculate the change in working capital, you must first calculate the working capital for two points in time.

Working capital requirement calculation

These companies might have difficulty keeping enough working capital on hand to get through any unforeseen problems. These businesses specialize in expensive items that take a long time to assemble and sell, so they can’t raise cash quickly from inventory. They have a very high number of fixed assets that cannot be liquidated and expensive equipment that caters to a specific market. One of the main advantages of looking at a company’s working capital position is the ability to foresee any financial difficulties. Even a business with billions of dollars in fixed assets will quickly find itself in bankruptcy court if it can’t pay its bills when they come due.

The Change in Working Capital could positively or negatively affect a company’s valuation, depending on the company’s business model and market. The Change in Working Capital could be positive or negative, and it will increase or reduce the company’s Cash Flow (and Unlevered Free Cash Flow, Free Cash Flow, and so on) depending on its sign. Therefore, there might be significant differences between the “after-tax profits” a company records and the cash flow it generates from its business. Because cash generates so quickly, management can stockpile the proceeds from its daily sales for a short period. This makes it unnecessary to keep large amounts of net working capital on hand to deal with a financial crisis. Most major new projects, such as an expansion in production or into new markets, require an upfront investment.

Below is a short video explaining how the operating activities of a business impact the working capital accounts, which are then used to determine a company’s NWC. NWC is most commonly calculated by excluding cash and debt (current portion only). Often some companies don’t have knowledge about the tax deductions that can benefit the company. Also, see if there are any deductions that you can earn from the taxes you’re going to pay. Thus, you need to work and keep a check on the funds so that the value doesn’t fall down. Now that you know why working capital is important for the company, let’s see how you can improve your negative value to a positive one.

The 5 Financial KPIs You Should Follow Daily

Under the best circumstances, insufficient working capital levels can lead to financial pressures on a company, which will increase its borrowing and the number of late payments made to creditors and vendors. A company can also improve working capital by reducing its short-term debts. The company can avoid taking on debt when unnecessary or expensive, and the company can strive to get the best credit terms available. The company can be mindful of spending both externally to vendors and internally with what staff they have on hand. In mergers or very fast-paced companies, agreements can be missed or invoices can be processed incorrectly.

Why a style blend of small- and mid-caps may belong in a DC plan – Schroders

Why a style blend of small- and mid-caps may belong in a DC plan.

Posted: Sun, 06 Aug 2023 07:00:00 GMT [source]

Though the amount should be positive, it can be a negative amount in times of distress. The Change in Net Working Capital (NWC) section of the cash flow statement tracks the net change in operating assets and operating liabilities across a specified period. Negative working capital on a balance sheet typically means a company is not sufficiently liquid to pay its bills for the next 12 months and sustain growth.

What is working capital ratio?

The net working capital metric is a measure of liquidity that helps determine whether a company can pay off its current liabilities with its current assets on hand. Businesses keep accounting records and aggregate their financial data on financial reports. To find the information you need to calculate working capital, you’ll need the company’s balance sheet. Current assets and liabilities are both common balance sheet entries, so you shouldn’t need to do any other calculating or assuming.

- With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support.

- Small business owners use net working capital to better understand their company’s immediate financial health.

- However, the firm also needs to see that they don’t waste the funds because it might cause the working capital to turn negative.

- Divide that difference by the earlier period’s working capital to calculate this change as a percentage.

- This means the company has $150,000 at its disposal in the short term if it needed to raise money for a specific reason.

Below 1, a business is operating with a net negative working capital position. The ratio refers to the proportional relationship between assets and liabilities. When working capital ratio is above 1, a business can theoretically pay off all its liabilities with its existing assets.

Change in Net Working Capital Formula Calculator

A positive change in the working capital can increase the cash flow of the company. Beyond that, calculating NWC requires looking at current or liquid assets, but not all current assets are equally liquid. For example, inventory is a liquid and current asset, but it can take a long time to sell inventory — it isn’t a reliable source of cash to pay off short-term debts.

Ingersoll Rand Inc. (NYSE:IR) Q2 2023 Earnings Call Transcript – Yahoo Finance

Ingersoll Rand Inc. (NYSE:IR) Q2 2023 Earnings Call Transcript.

Posted: Sat, 05 Aug 2023 16:21:03 GMT [source]

The ratio increasing over time is generally a sign of an improved working capital position and vice versa. With NetSuite, you go live in a predictable timeframe — smart, stepped implementations begin with sales and span the entire customer lifecycle, so there’s continuity from sales to services to support. To get started calculating your company’s working capital, download our free working capital template. The following working capital example is based on the March 31, 2020, balance sheet of aluminum producer Alcoa Corp., as listed in its 10-Q SEC filing. Monitoring the right financial KPIs can help you reach your objectives and optimise your business strategy. Discover the 5 KPIs that will allow you to analyse your financial performance, predict growth and help you turn a profit.

There are two ways to address a negative change in net working capital. First, you can manage your liabilities so that they are lower than your assets. Second, you can increase your assets so that they are higher than your liabilities. Every business has working capital to varying degrees; it’s the amount of money it takes to keep the lights on and employees paid. The challenge for small business owners is that changes in net working capital are not always easy to identify. To understand what changes in net working capital mean, you need to understand how businesses operate.

See to it that your payment is made on time and as well as you receive payment on time. Any company will never want to be in a situation where they’re lacking money to pay their debts. It will help you save beforehand if your company is going to run out of cash. A negative or zero working capital is an indication that the company will sooner or later face a cash crisis. Therefore, keep an eye on the changing working capital of your company. If you pay the expenses like the salary of the people working in the company, even the employees will feel secure about the company.

Is Working Capital An Asset?

What was once a long-term liability, such as a 10-year loan, becomes a current liability in the ninth year when the repayment deadline is less than a year away. Both companies have a working capital (assets – liabilities) of $500,000, but Company A has a working capital ratio of 2, whereas Company B has a ratio of 1.1. On the other hand, a working we can see working capital figure changing capital ratio that strays above 2 can also be seen as unfavorable, representing that the business is hoarding too much cash and not investing proactively enough in growth. Businesses tend to calculate working capital ratio on a regular basis due in part to its ability to reflect working capital position changes over time accurately.

The best rule of thumb is to follow what the company does in its financial statements rather than trying to come up with your own definitions. That explains why the Change in Working Capital has a negative sign when Working Capital increases, while it has a positive sign when Working Capital decreases. As with all financial analysis ratios and formulas, you should use them to build a holistic picture of the value of an investment. One company’s working capital will be different from another similar company, so comparing them may not be ideal for using the concept. Negative working capital can be a good thing for businesses that have high inventory turnover.

Ways to Increase Working Capital

Working capital is a cash flow problem that needs to be solved for a business to survive. Because of this, it is important for all business owners to know how to do this calculation of working capital with an example. Effective working capital management enables the business to fund the cost of operations and pay short-term debt. Cash flow is the amount of cash and cash equivalents that moves in and out of the business during an accounting period. A good working capital ratio is considered to be 1.5 to 2, and suggests a company is on solid financial ground in terms of liquidity. Less than one is taken as a negative working capital ratio, signalling potential future liquidity problems.

- As for payables, the increase was likely caused by delayed payments to suppliers.

- But Company A is in a stronger position because Deferred Revenue represents cash that it has collected for products and services that it has not yet delivered.

- Changes in working capital can be a red flag, particularly for small businesses that cannot afford to wait for cash flow to even out.

- If a company is fully operating, it’s likely that several—if not most—current asset and current liability accounts will change.

- The working capital ratio, also known as the current ratio, is commonly used to assess the company’s working capital.

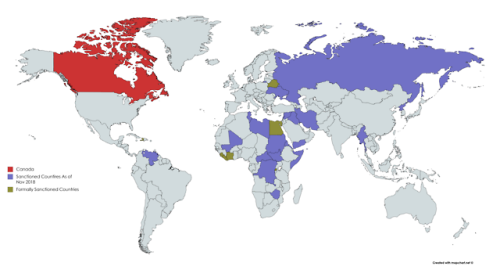

In addition, the recovery could be different from country to country. That’s something to keep in mind as you choose your investment targets. For example, an expert trade credit insurer can advise and help you make better-informed decisions.